A Life Insurance Rider That Allows an Individual to

Apply for this life insurance from New York Life and Join AARP today. Living benefit and death benefit riders.

Be An Insurance Expert With The Insurancedecoder Don T Miss Out On Any Benefits Life Insurance Simplifying Life Insurance

Adding one or more riders enables you to customize your policy to your needs 27.

. The Additional Purchase Benefit APB is a rider that allows the insured individual to purchase additional life insurance during specific timeframes or when you experience certain life events without needing to prove their insurability. Accelerated Death Benefit Rider An accelerated death benefit rider allows a portion of the policys death benefit to be claimed early if the insured 28. Group of answer choices.

But if you have a terminal or chronic illness you may need financial assistance before you pass away given the substantial cost of end-of-life care. There are two generic categories of riders. A life insurance rider allows an individual to increase coverage to an existing life insurance policy.

A life insurance rider that allows an individual to purchase insurance as they grow older regardless of insurability is called an Guaranteed insurability rider not Guaranteed term rider YOU MIGHT ALSO LIKE. Only found on permanent life insurance policies such as whole life insurance and universal life insurance this rider allows you to increase your insurance coverage. If a person had an accidental death away from home will his or her insurance pay towards the remains to be transported home.

This type of living benefit is designed. Cost of living rider. What is a rider on a life insurance policy.

Life insurance riders are optional benefits you can add on top of the normal coverage your life policy offers. A life insurance rider that allows an individual to purchase insurance as they grow older regardless of insurability is called an guaranteed insurability rider Loans obtained by a policyowner against the cash value of a life insurance policy. Heres a list of typical life insurance riders and what they provide.

A transportable rider will pay towards this cost. For example you may add a rider that lets you defer your premiums if you become disabled or another that lets you add more coverage later without a medical exam. Loans obtained by a policyowner against the cash value of a life insurance policy.

Ad Affordable coverage from 10000 to 100000. Life insurance is designed to help provide your loved ones a death benefit if you die while the policy is in force. Smaller premium - Which of the following is the key characteristic of term life insurance.

Need insurance answers now. Reviews Trusted by 45000000. Guaranteed Insurability Rider.

Loans obtained by a policyowner against the cash value of a life insurance policy. These dates typically coincide with the individual reaching a certain age. Common life insurance riders may allow you to add coverage for immediate family members to an existing policy.

A life insurance rider that allows an individual to purchase insurance as they grow older regardless of insurability is called an would not be treated as taxable income. Many people choose a spousal rider rather than getting a separate life insurance policy. A guaranteed insurability rider also known as a guaranteed purchase option rider allows you to increase your policys death benefit without.

Additional Purchase Benefit. A life insurance rider that allows an individual to purchase insurance as they grow older regardless of insurability is called an guaranteed term rider. Accelerated Death Benefit Rider.

- Term life insurance allows a particular individual to buy a larger amount of insurance with an _____ than whole life insurance. Childrens term insurance rider. Call 1-888-601-9980 to speak to our licensed advisors right away or book some time with them below.

Common life insurance riders. B guaranteed insurability rider. Group of answer choices.

A life insurance rider that allows an individual to purchase insurance as they grow older regardless of insurability is called an A guaranteed term rider B guaranteed insurability rider C accelerated benefit rider D cost of living rider. The spousal rider was once one of the most po pular life insurance riders. A rider on a life insurance policy is an optional add-on that allows you to customize your standard life insurance for a small additional cost.

What is a rider on a life insurance policy. This type of rider helps take care of expenses associated with the passing of a child. The compensation could be used for things such as funeral costs and hospital bills.

It is not as common as it once was as more insurance companies now encourage people to buy individual policies. A life insurance rider is an optional feature that can be added on to a life insurance policy to enhance and customize it to better address ones unique needs. Depending on the rider it may be available with a permanent life insurance policy a term policy or both.

Jul 13 2021 These are often available on permanent life insurance policies. Learn about becoming an AARP member. But by including a rider you can expand your coverage without taking out multiple insurance policies.

This type of rider allows you to add life insurance coverage for a spouse. Your life insurance policy remains in force - just as if you were making premium payments yourself. The guaranteed insurability GI rider is available on certain life insurance policies and allows you to purchase additional insurance at specific dates in the future subject to minimums and maximums without having to go through an exam or answer health questions.

If you become totally disabled unable to work and cant afford to pay your life insurance premiums a waiver of premium rider allows you to stop paying premiums and still continue your policy until you are able to return to work full-time. Ad Compare the Best Life Insurance Providers.

/insurance-life-protect-help-secure-care-1576403-pxhere.com-015a0a012f484af2bfe5a897031015a2.jpg)

Key Person Insurance Definition

Get Our Image Of Life Insurance Needs Analysis Template For Free Health Insurance Quote Individual Health Insurance Health Insurance

/AAALifeLogo_resize-d7b51e467fdf421d9af5ef581e9286cb.jpg)

The 5 Best Return Of Premium Life Insurance Of 2022

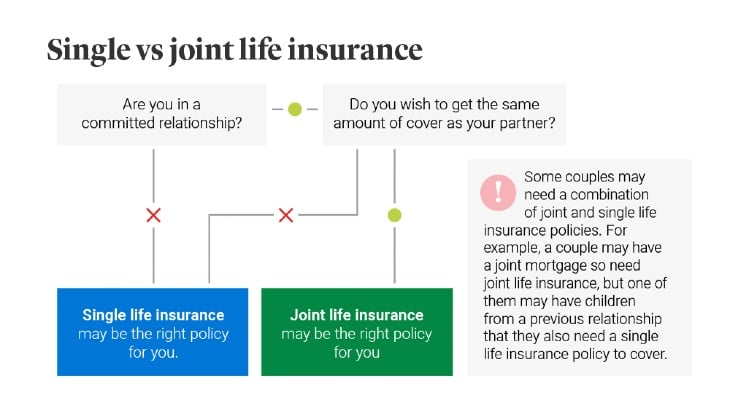

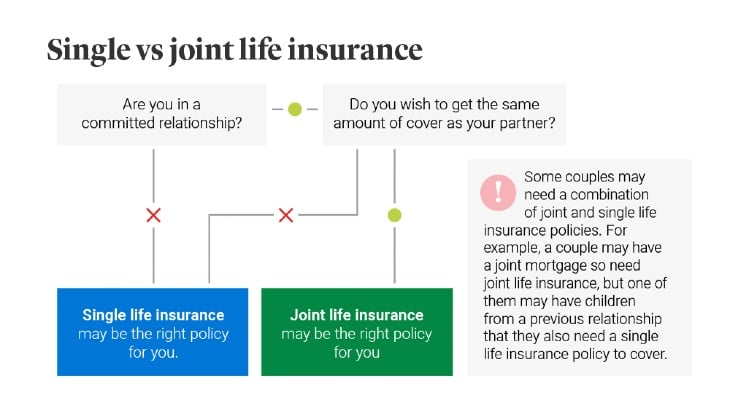

Legal General Single Vs Joint Life Insurance

Life Insurance For Your Family Legal General

Life Insurance Riders Explained Forbes Advisor

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

Get Update Online Sbi Life Insurance Policy Status Life Insurance Policy Life Life Insurance

Comments

Post a Comment